Let’s break down the 50 most important terms and phrases in bitcoin trading.

Address

An address is something comparable to a checking account. To put it simply, it’s the location where you can send out and receive Bitcoin. This is something every Bitcoin trader has.

Altcoin

This is a term that refers to any other cryptocurrency besides Bitcoin. There are great deals of cryptocurrencies you’ll encounter online. Some of them are as popular as Bitcoin while others are brand-new on the marketplace and are attempting to go far for themselves.

Arbitrage

This is a term used to describe taking advantage of trading. The particular advantage it describes is the difference in between 2 exchanges. For example, in one exchange Bitcoin is selling for $7,000 and in another, it’s selling for $8,000. When it comes to the arbitrage, you ‘d purchase Bitcoin at the first exchange and sell it at the 2nd. You’ll be making a profit of $1,000.

ASIC

Application-specific integrated circuits (ASICs) can be considered “crypto mining machines.”

In the early days of crypto, a lot of mining was performed on CPUs and GPUs– certainly, Bitcoin was developed particularly to be mined on standard computers.

But by the mid-2010s, it had actually ended up being impossible to carry out profitable mining operations utilizing daily devices because of limits on calculating power and the expenses connected with energy consumption.

ASICs take on both these problems. They are created entirely for mining (and some ASICs are purpose constructed for mining particular cryptocurrencies)– and they can likewise be crafted to maximize computing power while keeping energy demands to a minimum.

Today, all large-scale crypto mining is conducted using ASICs, typically in closely controlled information centers. They’re normally based in nations where power is reasonably inexpensive.

ATH (All Time High)

Bitcoin is understood to be an extremely unpredictable cryptocurrency. It has its highs and lows and the ATH can be used to better determine the rate and prospective earnings you can make. Additionally, Bitcoin can have several highs prior to reaching a brand-new ATH.

Bear/ Bearish

Bears are the reverse of bulls. These traders are positive about the decline in the cost of a particular property. These trades have a bearish mindset.

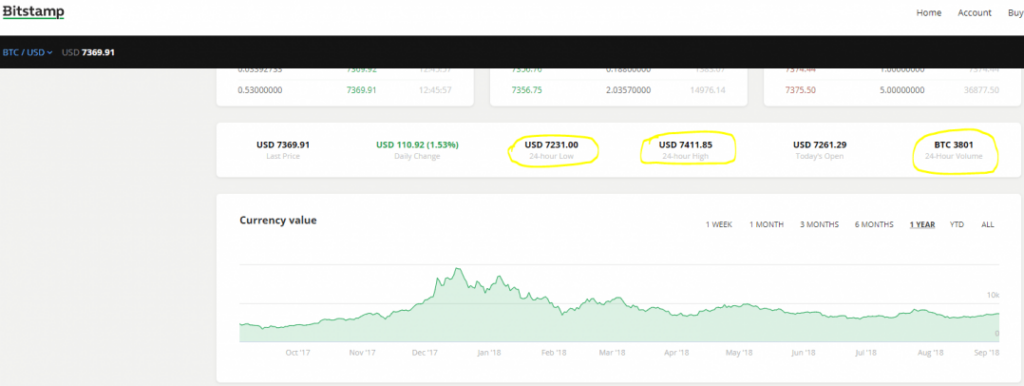

Bitcoin Price

Whenever individuals describe Bitcoin’s “price”, they are really describing the price of the last profession conducted on a specific trading platform. This crucial distinction happens because, unlike United States bucks, for example, there is no solitary, international Bitcoin price that everybody complies with.

For example, Bitcoin’s cost in specific countries can be different from its cost in the US, given that the major exchanges in these nations include different trades.

Note: Alongside the rate, you will certainly occasionally additionally see the terms low and high. These terms describe the greatest and cheapest Bitcoin costs in the last 24 hr.

Blockchain

The Bitcoin blockchain is the distributed journal system. It’s comprised of a number of blocks containing all the validated transactions. The blockchain is a decentralized system and the deals on the journal cannot be removed.

Trading bots have also become pretty popular. If you’re searching for one then you should find out more about Bitcoin Loophole. This platform lets you begin trading with simply 3 easy steps. First, you make an account. Then you deposit the minimum quantity of $250 and off to the final step. Once you change the bot’s settings then you can let it do the effort for you. Make sure to examine it from time to time.

Blocks

Numerous digital currencies utilize blocks, which consist of deals that have been confirmed and then combined together.

Bull

Bulls are traders that believe that some property’s rate will rise. If a trader is positive about the cost increasing then that’s called a bullish mindset.

Consensus

The network for a digital currency reaches consensus when the network’s nodes concur that a deal happened. This contract is vital if the differing network participants (nodes) are to have the same details. To put it simply, agreement is crucial to dispersed ledger systems.

Cryptoasset

Cryptoassets are possessions in the form of a digital token, protected by cryptography and built on blockchain innovation. The term refers to the token itself rather than the software application upon which it is developed. For instance, Ethereum’s cryptoasset is ether (ETH). Sometimes, including Bitcoin, the software application and the cryptoasset bear the exact same name– for those currencies, you can compare them since the name of the software is capitalized (“Bitcoin”) while the cryptoasset is written in all lowercase (“bitcoin,” or “BTC”).

Cryptocurrency

A cryptocurrency is simply a currency that relies on cryptography. Bitcoin, for example, leverages cryptography in order to validate deals.

DDoS Attack

A dispersed denial of service (DDoS) attack happens when numerous celebrations work together to overwhelm a system by inundating it with either requests for information or harmful information. [4] Generally, the wicked parties associated with such an attack wish to prevent a resource, such as a server, from having the ability to provide some particular service, such as serving a web page.

Some digital currency exchanges have actually suffered DDoS attacks from wicked parties seeking to maim these marketplaces and hopefully take advantage of this vulnerability to take cryptocurrency. [5] While efforts to steal digital properties might not work, an exchange’s users could end up being unhappy just since they can not make trades through the market.

Distributed Ledger

A distributed ledger is a system of taping information that is simply dispersed, or spread throughout, many different devices. The blockchain, for example, is a distributed ledger that was initially developed to track all bitcoin transactions.

Escrow

Escrow refers to a third-party holding financial resources on the behalf of other parties. [6] A third-party would hold funds in escrow when the other entities associated with a transaction may not rely on each other.

Exchange

To put it merely, an exchange is like a market location. If you want to buy or sell Bitcoin then you need to go to an exchange. When trading Bitcoin you can utilize different apps and sites that will assist you while doing so.

Fiat Currencies

Fiat currencies are currencies that have worth due to the fact that they are minted by a reserve bank. Fiat means “by decree,” and these currencies have value because some central authority has actually decreed that they have monetary value. Examples of fiat currencies include the British pound, euro and Japanese yen.

FOMO (Worry Of Missing Out)

This occurs when financiers begin buying a certain asset due to the fact that they anticipate its cost will rise in the future. This in turn gets the attention of other financiers that likewise start buying that property in worry of losing out. However, this can be utilized to control investors into buying a property whose worth drops.

Fork

A fork is a change in a digital currency’s rules or procedure. Developers update a cryptocurrency’s protocol from time to time. A fork can be either a tough fork or a soft fork. A hard fork is a change to a digital currency’s procedure that makes blocks created utilizing the old protocol incompatible with the brand-new chain.

FUD

Worry, uncertainty and doubt can be summarized using the term “FUD.” The concept behind this is that market participants might spread misleading or inaccurate details in order to trigger a possession’s rate to decrease. A trader may desire a possession’s cost to fall so they can either short it effectively or purchase in at a lower cost and increase their possibility of producing a gain.

Hard Fork

A tough fork is a kind of fork that produces a long-term modification to a digital currency’s protocol, or rules. When one of these forks happens, it leads to an entire brand-new blockchain, which will decline any blocks mined using the old guidelines.

The old chain can endure, however, causing a situation where both the old and the new blockchains can continue.

HODL (Hold on for Dear Life)

This term is really a misspelling of the word hold. Later it ended up being the abbreviation that’s known today. As pointed out previously, Bitcoin is an unpredictable cryptocurrency. This means that its rate can grow rapidly so if you have such an asset then you ought to hold on for dear life.

Initial Coin Offering

A preliminary coin offering (ICO) represents the first time that an organisation provides digital tokens to the public in an effort to raise money. Business regularly hold these offerings so they can fund tasks.

These digital token sales have actually frequently been likened to going publics (IPOs), where companies offer more conventional assets such as stocks and bonds in order to raise money.

KYC

KYC stands for “understand your consumer.” Lots of jurisdictions have KYC regulations, which have actually concerned impact start-ups holding ICOs. These regulations require business holding these digital token sales to verify the identity of their investors. [10] POS.

Limit Order

It permits you to buy or sell Bitcoin at a specific cost that you decide on. To put it simply, the order might not be entirely met, since there will not suffice customers or sellers to meet your requirements.

Let’s claim that you put a limitation order to get five Bitcoins at $10,000 per coin. Then you could end up only owning 4 Bitcoins due to the fact that there were nothing else sellers ready to offer you the final Bitcoin at $10,000. The continuing to be order for 1 Bitcoin will remain there up until the price hits $10,000 once again, as well as the order will after that be fulfilled.

Long/Long Position

Going long, likewise known as taking a long position, implies making a wager that an asset will rise in value. If a trader purchases a digital currency like bitcoin, for example, they are making a bet that the cryptocurrency will appreciate.

While just buying digital currency is one example of taking a long position, there are other techniques available. For example, traders can leverage choices and futures.

Maker and Taker fees

Other terms that you might come across when trading is manufacturer fees as well as taker fees. Personally, I still locate this design to be one of the extra complicated ones, yet allow’s attempt to break it down.

Exchanges want to urge individuals to trade. In other words, they want to “make a market.” For that reason, whenever you produce a new order that can’t be matched by any kind of existing purchaser or seller, i.e., a limit order, you’re generally a market maker, and also you will normally have reduced fees.

On the other hand, a market taker places orders that are promptly fulfilled, i.e. market orders, since there was currently a market manufacturer in place to match their demands. Takers get rid of a company from the exchange, so they generally have higher fees than manufacturers, that add orders to the exchange’s order publication.

For example, perhaps you put a restriction order in to purchase one Bitcoin at $10,000 (at a lot of), but the most affordable vendor is just ready to sell at $11,000. After that you have actually simply developed a brand-new market for sellers that wish to cost $10,000.

So, whenever you place a buy order listed below the marketplace cost or a sell order above the market rate, you become a market maker.

Utilizing that exact same instance, perhaps you put a limit order to purchase one Bitcoin at $12,000 (at many), and also the most affordable seller is selling one Bitcoin at $11,000. After that, your order will be promptly met. You will certainly be getting rid of orders from the exchange’s order book, so you’re considered a market taker.

Market (or Instant) Order

This sort of order can be set on a trading system and it will be instantly fulfilled at any feasible cost. You only established the number of Bitcoins you desire to buy or market as well as buy the exchange to implement it instantly. The trading platform then matches vendors or buyers to fulfill your order, respectfully.

When the order is positioned, there is a likelihood that your order will certainly not be matched by a single customer or vendor, but instead by multiple individuals, at different costs.

For instance, allow’s state you put a market order to purchase 5 Bitcoins. The trading platform is currently trying to find the most affordable sellers readily available.

The order will certainly be completed once it builds up sufficient sellers to hand over 5 Bitcoins. Relying on sellers schedule, you could wind up buying 3 Bitcoins at one price, and the various other 2 at a higher cost.

In other words, in a market order, you don’t stop acquiring or selling Bitcoins till the amount asked for is gotten to. With market orders, you might wind up paying extra or costing much less than you planned, so take care.

Market Cap

Market cap is short for market capitalisation, which is a term for overall market value. The marketplace cap of bitcoin, for example, is the number of BTC exceptional increased by the digital currency’s cost. The term can also be used to describe a group of digital currencies.

Mining

Similarly, to real mining, Bitcoin mining indicates getting brand-new Bitcoin units once a block is diminished. Bitcoin miners require severe hardware and electrical energy to mine. As a reward for contributing these resources, they get digital tokens.

Mining Incentive

The mining incentive is a benefit that miners get for verifying deals and mining them in to blocks. Confirming the transactions of the bitcoin network, for example, needs specialised hardware and substantial electrical power, so miners are compensated with a mining incentive.

At first, bitcoin’s mining reward was 50 BTC, however at the time of report, the benefit had actually dropped to 12.5 BTC.

Moon/Mooning

When a digital currency moons, that means it increases greatly in worth. For example, a crypto trader might talk about how an altcoin is going “to the moon!”.

Noob

If you’re brand-new to the market then you’re a noob. Instead of leaping right in you must sit and observe the marketplace. This will let you understand how it works and how to finest use your budget plan. Avoid making rash decisions if you’re a noob.

POS

represents “evidence of stake,” which is another method of verifying transactions. The digital currencies that use this technique to verification often supply all their digital tokens in advance, and miners are selected based on how many systems they have (their stake). [12] In these cases, users who confirm transactions, in some cases described as “forgers,” receive transaction fees for their contributions.

POW

POW is an acronym for “proof of work,” which is a system of proving that a digital currency’s transactions have actually been confirmed. Many digital currencies, including bitcoin, use POW. Under such a system, miners should do “work” that is tough for them to contribute, however easy for the more comprehensive network to confirm.

Miners are usually rewarded for validating deals by receiving units of a digital currency.

Private Key

A personal key is a piece of information– presented as a string of numbers and letters– that a financier can use to access their digital currency.

Public Key

A public key is an address where an investor can receive digital currencies. This public key, like the private key, is a combination of numbers and letters.

Pump and Dispose

A “pump and dump” is a type of investment plan where a market individual– or several– interact to inflate the price of a property so they can sell it when its value is artificially high. This practice might be particularly pervasive when it pertains to digital currencies, as traders can easily get together utilizing Telegram groups with the objective of triggering particular cryptocurrencies to rise sharply in worth. [14] Satoshi Nakamoto.

Satoshi Nakamoto is the pseudonym for the creator of bitcoin, and more than one person has actually declared to be Nakamoto. Nevertheless, none of these claimants have managed to persuade the more comprehensive cryptocurrency neighborhood that they are, in fact, the developer of bitcoin.

Rekt

The term “rekt” is crypto trader slang for “trashed.” Generally, it indicates that a trader lost significant amounts of cash.

ROI

ROI is short for “roi.” Generally, if a financier puts their cash in to a digital currency, they are doing so with the hope that they will receive an engaging return.

Short/Shorting

Shorting a possession, likewise referred to as taking a brief position, means making a bet that the asset will fall in value. There are several methods that traders can utilize to brief digital currencies, including futures, options and margin trading. [16] Investors considering this approach needs to keep in mind it involves a lot of threat, specifically with cryptocurrencies because of their unstable nature.

Stop-Loss Order

Let’s you establish a specific cost that you intend to cost in the future, in situation the rate drops considerably. This sort of order serves for reducing losses.

It’s essentially an order that informs the trading platform the following: if the rate stop by a particular percent or to a particular point, I will certainly offer my Bitcoins at the preset price, so I will lose as little cash as feasible. A stop-loss order serves as a market order.

Simply put, as soon as the stop rate is gotten to, the market will start marketing your coins at any price till the order is fulfilled.

Summary

Financiers who are thinking of getting involved with cryptocurrency needs to keep in mind that market terms can be hugely useful. By performing the essential research and discovering this information, would-be traders can increase their possibilities of fulfilling their financial investment goals.

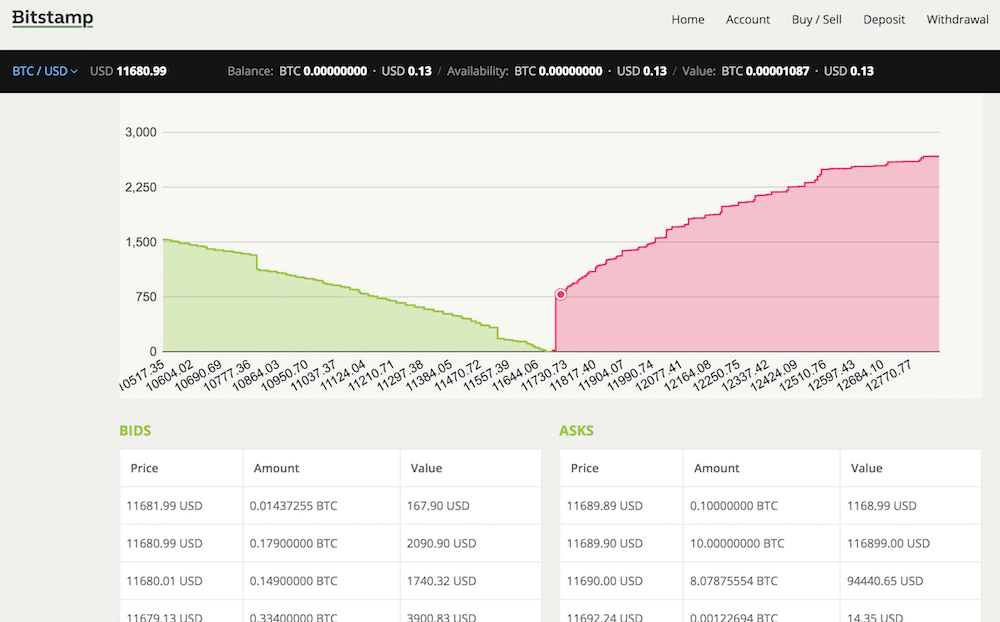

The Order Book

The complete list of buy orders as well as market orders is detailed on the market’s order book, which can be viewed on the trading platform. The buy orders are called proposals considering that people are bidding on the prices to buy Bitcoin. The sell orders are called asks, given that they show the asking price that the sellers request.

Token

A digital token is an unit of a digital currency, such as a bitcoin. It deserves keeping in mind that a few of these tokens are utilized for particular environments, and those are regularly described as energy tokens. Other digital tokens are basically securities.

Trading Platforms vs. Brokers vs. Marketplaces

Bitcoin trading systems are online sites where purchasers and vendors are automatically matched. Keep in mind that a trading platform is various from a Bitcoin broker, such as Coinmama.

Unlike trading systems, brokers offer you Bitcoin straight and normally for a higher charge. A trading platform is additionally various from an industry such as LocalBitcoins, where buyers, as well as sellers, communicate directly with each other, in order to finish a profession.

Volume

The volume represents the number of overall Bitcoins that have actually been traded in a provided duration. Volume is utilized by investors to recognize how significant a pattern is; considerable trends are usually gone along with by huge trading volumes, while weak fads are come with by low quantities.

As an example, a healthy and balanced upward trend will certainly be gone along with by high quantities when the cost surges and also low quantities when the cost decreases.

If you are experiencing an abrupt modification of direction in the cost, experts suggest examining how significant the trading quantity is, in order to figure out if it’s simply a minor adjustment or the beginning of a contrary pattern.

Whale

The term “whale” is used to describe a trader who makes sizable bets. This term is a good one to understand because market participants with the capability to perform very large transactions can possibly control the marketplace– or “make waves in the ocean.”.

White Paper

The developers who create digital currencies generally supply white documents for these innovative properties. These documents typically offer detailed details on the digital token in question, along with its underlying technology.

For example, the bitcoin white paper offered info on a “peer-to-peer electronic cash system.” Financiers who are thinking about taking part in ICOs can benefit considerably from examining any available white documents on the subject.