Introduction:

The Bitcoin halving, a highly anticipated event in the cryptocurrency world, occurs approximately every four years and has a significant impact on the supply and demand dynamics of Bitcoin. In this article, we’ll explore what the Bitcoin halving is, why it’s important, and its potential impact on the cryptocurrency market.

What is the Bitcoin Halving?

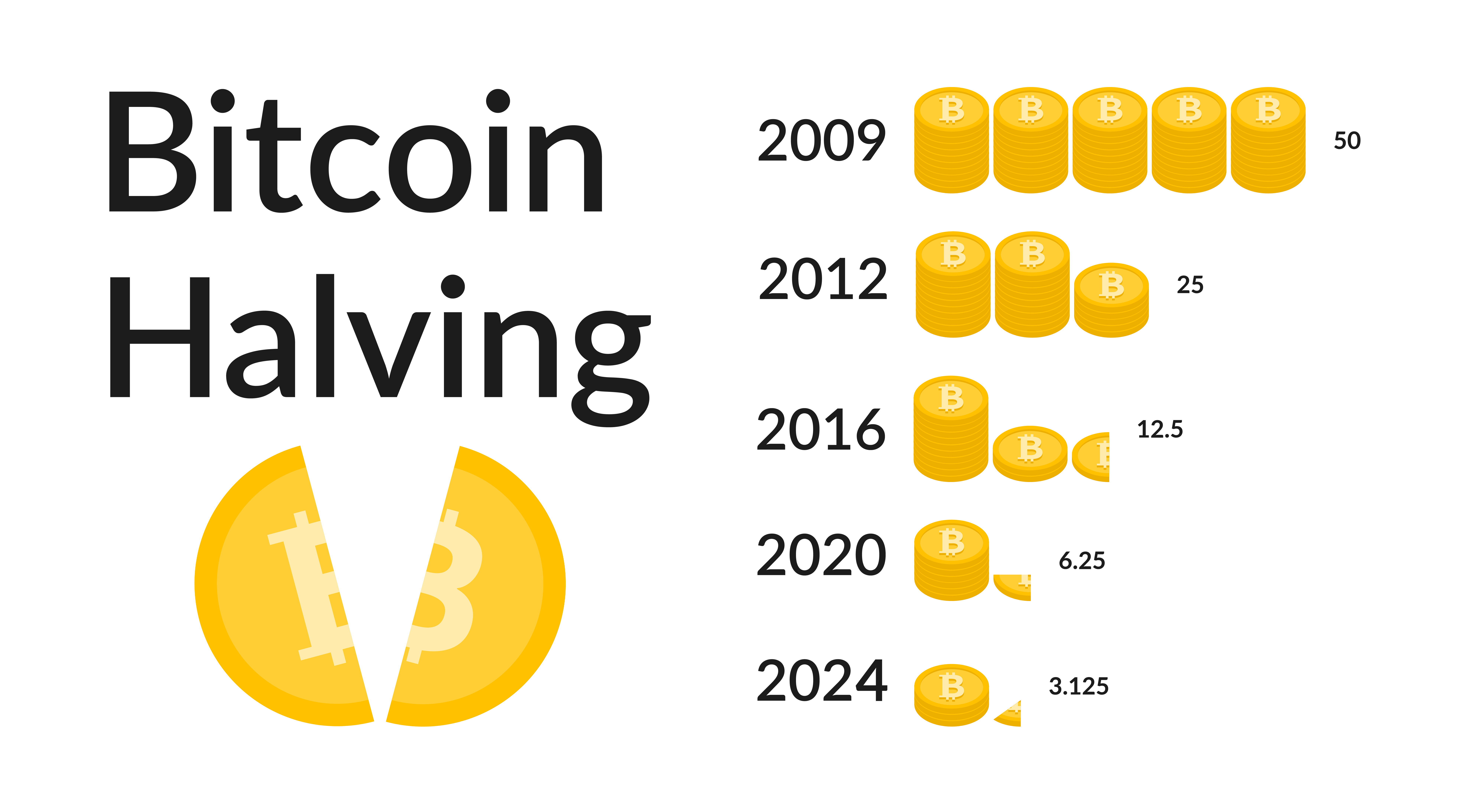

The Bitcoin halving is a pre-programmed event in the Bitcoin protocol that reduces the reward miners receive for validating transactions and adding them to the blockchain. This reduction happens approximately every four years, specifically after every 210,000 blocks are mined, or roughly every four years.

The Impact of the Halving on Bitcoin’s Supply:

The primary impact of the halving is on Bitcoin’s inflation rate. With each halving, the rate at which new Bitcoins are created is cut in half. This reduction in the rate of new supply has a significant impact on Bitcoin’s overall supply dynamics.

- Scarcity and Increased Demand:

- The reduction in the rate of new Bitcoin creation increases Bitcoin’s scarcity. As a result, the existing supply becomes more limited, potentially driving up demand and, consequently, the price.

- Scarcity is one of the fundamental principles of economics, and Bitcoin’s fixed supply of 21 million coins makes it a deflationary asset.

- Miner Revenue and Network Security:

- The halving also affects miner revenue. With the block reward cut in half, miners receive fewer Bitcoins for their efforts. This reduction in revenue can lead to less efficient miners shutting down their operations, potentially affecting the overall security of the Bitcoin network.

- Historical Price Trends:

- Looking back at previous halving events, there is evidence to suggest that they have had a significant impact on Bitcoin’s price.

- The first two halving events, which occurred in 2012 and 2016, were followed by substantial price increases. However, it’s important to note that past performance is not indicative of future results.

The 2020 Halving and its Aftermath:

The most recent Bitcoin halving occurred on May 11, 2020. In the months leading up to the event, there was much speculation about its potential impact on Bitcoin’s price.

- Pre-Halving Speculation:

- In the months leading up to the 2020 halving, there was a significant increase in interest from investors and traders. Many anticipated that the reduction in the block reward would lead to a supply shock and drive up the price of Bitcoin.

- Post-Halving Price Action:

- Following the 2020 halving, Bitcoin’s price initially experienced some volatility but eventually began a sustained upward trend.

- In the months following the halving, Bitcoin’s price reached new all-time highs, surpassing its previous peak of $20,000.

Conclusion:

The Bitcoin halving is a crucial event that has a significant impact on the cryptocurrency market. By reducing the rate of new supply, the halving increases Bitcoin’s scarcity and can potentially drive up demand and price. While past halving events have been followed by substantial price increases, it’s essential to remember that the cryptocurrency market is highly volatile, and there are no guarantees of future performance. As such, investors should conduct thorough research and exercise caution when investing in Bitcoin or any other cryptocurrency.